Investor Information

Stock Exchanges Intimations

8 Apr 2024

Board Meeting Intimation Q4 2023-24

8 Apr 2024

27 Mar 2024

In The News

Investor Contacts

Financial Calender

Note: All future dates are indicative only and subject to change.

- FY 2023-2024 Results Calendar

- Annual General Meeting

- Conference Call

Q1 – On or before July, 2023

Q2 – On or before October, 2023

Q3 – On or before January, 2024

Q4 – On or before April, 2024

The Annual General Meeting (AGM) of the company for the Financial Year Ended March 31, 2023 is expected to be held on or before September 30, 2023.

The post results conference call are always organised after announcement of the quarterly results on the same day as per schedule or as may be intimated to the exchange in every quarter. Additional details on time and dial-in numbers will be made available in the Announcement section of this webpage.

Investor Contacts

Investor Enquiries

Mr Dinesh Kalani (Company Secretary)

Contact Details of Key Managerial Personnel

| Name | Designation | Contact Details |

|---|---|---|

| Mr. Hiral Chandrana | Global Chief Executive Officer |

Corporate Office:

Mastek Limited, #106, SDF - IV, Seepz, Andheri (East), Mumbai - 400 096 Tel: +91-22 67224200 Email Id: [email protected] |

| Mr. Arun Agarwal | Global Chief Financial Officer | |

| Mr. Dinesh Kalani | Company Secretary and Compliance Officer |

Investor Service forms for Shareholders holding Shares in Physical Form

| Purpose | Download |

|---|---|

| Request for registering PAN, KYC details OR changes / updations thereof. | Form ISR-1 |

| Confirmation of signature of securities holder by Banker. | Form ISR-2 |

| Declaration for Opting-out of Nomination. | Form ISR-3 |

Service requests for:

|

Form ISR-4 |

| Transmission | Form ISR-5 |

| Nomination Form | Form SH-13 |

| Cancellation OR Variation of Nomination | Form SH-14 |

| Electronic Clearing Services(ECS)Mandate form For Payment Of Dividend | ECS MANDATE |

| Declaration under sub-sections (1) and (1A) of section 197A of the Income-tax Act, 1961, to be made by an individual or a person (not being a company or a firm) claiming certain receipts without deduction of tax. | 15 G |

| Declaration under sub-section (1C) of section 197A of the Income-tax Act, 1961, to be made by an individual who is of the age of sixty years or more claiming certain receipts without deduction of tax. | 15 H |

Investor Enquiries

Mr. Hiral Chandrana (Global Chief Executive Officer)

Contact

+91-22-6722-4200

Contact Details

Corporate Office: Mastek Limited, #106, SDF - IV, Seepz, Andheri (East), Mumbai - 400 096

Investor Enquiries

Mr. Arun Agarwal (Global Chief Financial Officer)

Contact

+91-22-6722-4200

Contact Details

Corporate Office: Mastek Limited, #106, SDF - IV, Seepz, Andheri (East), Mumbai - 400 096

Investor Enquiries

Mr. Dinesh Kalani (Company Secretary and Compliance Officer)

Contact

+91-22-6722-4200

Contact Details

Corporate Office: Mastek Limited, #106, SDF - IV, Seepz, Andheri (East), Mumbai - 400 096

KFIN Technologies Limited

Mr. Ganesh Chandra Patro(Contact Person)

All inquiries related to shareholders’ accounting records, share transfers, transmission of shares, change of address, non-receipt of refund orders, loss of share certificates, etc., should be addressed to our share transfer agents at:

Contact

Toll Free no : 1800-309-4001

Address

Selenium Building, Tower-B, Plot No 31 & 32, Financial District, Nanakramguda, Serilingampally, Hyderabad, Rangareddy, Telangana India - 500 032

Now you can download the mobile app and see your portfolios serviced by KFINTECH. Check Dividend status, request for annual reports, change of address, change / update Bank mandate and download standard forms.

Register one time to use all the functionalities available on the website and / or the android mobile app.

Websites

- KPRISM

- KFIN Corporate

- Corporate Registry

- Investor Support Centre

Frequently Asked Questions

Frequently Asked Questions

The Company was incorporated in the name and style of “Management and Software Technology Private Limited” on May 14, 1982. The first public offering was made in 1992 followed by another public issue in 1996.

The Founder Members of the company are Mr. Ashank Desai, Mr. Ketan Mehta, Mr. Radhakrishnan Sundar and Mr. Sudhakar Ram.

The Company’s shares are listed in India on BSE Limited since March 30, 1993 and the National Stock Exchange of India Limited since May 10, 1995. (BSE Scrip Code: 523704; NSE Symbol: MASTEK).

The Company is an enterprise digital transformation specialist that engineers excellence for customers in the UK, US, and India. It enables large-scale business change programmes through its service offerings, which includes an application development, support, and testing, BI & analytics, agile consulting, & digital commerce. Whether it’s creating new applications, modernising existing ones or recovering failing projects, Mastek helps enterprises to navigate the digital landscape and stay competitive. With digital solutions constituting more than 80% to the business, Mastek is emerging as one of the leaders in Enterprise Digital Transformation journey. Mastek is well poised to be among the top providers of agile digital transformation solutions and a significant player within the digital transformation space in retail and financial services.

Evosys is a leading Oracle Cloud implementation and consultancy Company serving 1,000+ Oracle Cloud customers across 30+ countries. An Oracle Platinum partner, Evosys provides solution offerings like Oracle HCM Cloud, Oracle ERP Cloud, Oracle SCM Cloud, Oracle CX, Oracle EPM Cloud, PaaS solutions (including custom-built solutions), AI, IoT and machine learning. Evosys diverse customer portfolio consisting Government, Healthcare, Finance, Logistics, Manufacturing & Distribution organisations, is a testimony to the expertise and leadership in Oracle Cloud implementation. Evosys was recognised for winning ‘Oracle Partner of the Year’ Awards at Oracle OpenWorld 2019 for three times and the ‘Dream Employer of the Year‘ award from World HRD in 2019.

Mastek Vision 2020 Statement was to be a Global Leader in digital transformation services. Your Company have been steadfast in pursuit of this vision. Innovating, developing bespoke solutions and serving clients in a rapidly changing marketplace have enabled to reposition the Company from a commodity Indian – offshore IT services to a high-value impact and trusted digital transformation partner.

Passionate– We are fired-up about finding novel ways to exceed our customers’ expectations.

Accountable– Mastek 4.0 (our people transformation programme) empowers us to excel and accept individual ownership.

Collaborative– Mutual respect and teamwork enrich our business outcomes with unique perspectives and experiences.

Transparent – Open and honest behaviour is core to earn trust and deliver exceptional results for our stakeholders.

Sustainable – We increase our social dividend, investing as much

- Aligning to customer customers’ objectives, being proactive and taking actions to exceed their business impact providing innovative digital solutions and building software using latest delivery methodology & engineering practices to deliver superior value to our customers.

- Effective practice of “Quality Management System” ensuring quality standards of products and services are met prior to delivery through appropriate quality assurance and quality control.

- Practicing risk management as inherent part of our operations with appropriate mitigation planning and regular risk tracking.

- Striving for continual improvement of the Quality Management System

The Quality objectives are-

- Customer Experience – Satisfaction, Advocacy, Loyalty and Value for Money

- Quality of Deliverables.

- Timeliness of Deliveries.

- Productivity and Throughput

We endeavour to achieve client’s expectations, quality and delivery performance metrics for the industries.We serve as per the respective roadmaps, improve or retain our stakeholder’s engagement scores. Focus on building skills and capabilities to keep abreast with the changing demands of the businesses.

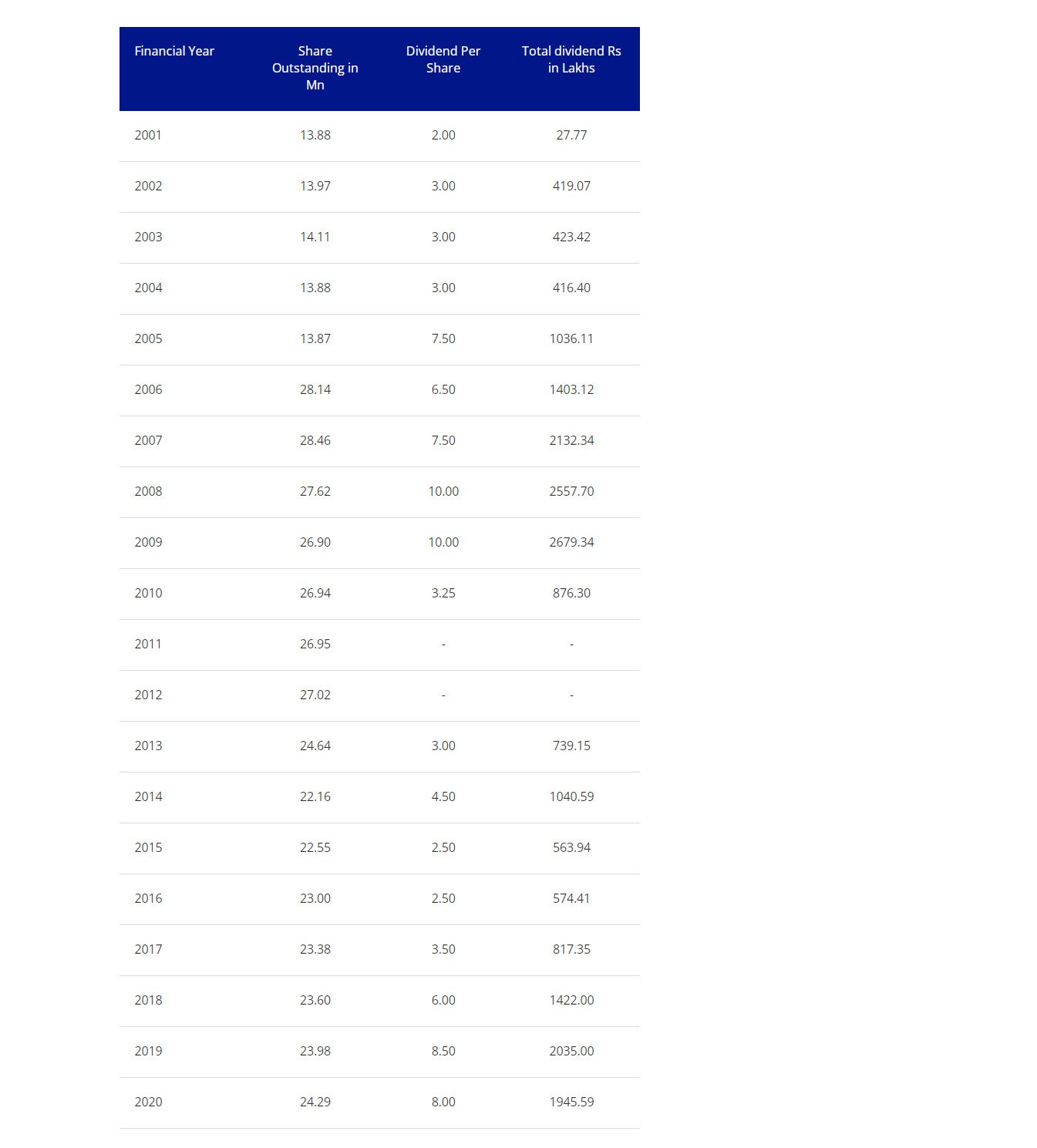

The Company had issued bonus shares in the ratio of 1:1 in January 2000 and also in April 2006. The Company’s shares were sub divided from Rs 10/- to Rs 5/- since November 2000.

The face value of the Company’s Equity Share is Rs 5/- per share. The Authorised Share Capital is divided into 4,00,00,000 Equity Shares of Rs 5/- each and 20,00,000 Preference Shares of Rs 100/- each. The issued, subscribed and paid up Equity Share Capital as on March 31, 2020 is Rs 12,14,47,360 and comprises of fully paid 2,42,89,472 Equity Shares of Rs 5/- each.

The Company’s Subsidiaries have increased (after the recent Evosys acquisition), the statement attached in Form AOC-1 Annexure to the Directors Report provides all the relevant details of our Subsidiaries.

As on March 31, 2020, the Group had 3,404 employees (including temporary/contractual).

The Company has 7 software development centers out of which 2 are located in and around Mumbai, 2 in Chennai and 1 each in Noida, Gurgaon and Pune.

The Company has Marketing offices in: UK, U.S.A, India and other Evosys locations as well.

The Fiscal Year of the Company is April 1 – March 31 every year.

Registered Office:

804 / 805, President House, Opposite C N Vidyalaya, Near Ambawadi Circle, Ambawadi, Ahmedabad-380006, Gujarat.

Tel: +91-79-2656-4337; Fax: +91-22-6695-1331;

E mail: [email protected]

Website: www.mastek.com

Corporate Office:

106/107, SDF IV, Seepz, Andheri (East), Mumbai – 400 096

Tel: +91-22-6722-4200; Fax: +91-22-6695-1331

The Company enjoys a good reputation for its sound financial management and the ability to meet its financial obligations. During the year under review, ICRA Limited, a Rating Agency, had reaffirmed the ratings assigned for the bank facilities as [ICRA] A+ (Positive) rating for fund based limits and [ICRA] A1+ for non-fund based limits for the Working Capital Facilities granted to the Company by its Bankers.

M/s. Walker Chandiok & Co. LLP, Chartered Accountants (Firm Registration No. 001076N/N500013), are the Statutory Auditors of the Company since 35th Annual General Meeting (“AGM”) of the Company for a period of 5 (five) consecutive years, commencing from the conclusion of 35th AGM till the conclusion of the 40th AGM. (Financial Year 2017–18 to Financial Year 2021-2022).

The Company does not offer a dividend reinvestment program or dividend stock program at present.

The Annual Report as well as Quarterly Results along with Analysis, Press Release and Analyst Presentation are available on the Company’s website at https://www.mastek.com//financial-information.

These are also available on the websites of BSE Limited (www.bseindia.com) and the National Stock Exchange of India Limited (www.nseindia.com), where the shares of the Company are listed.

The Shareholding Pattern can be obtained from the website of the Company at https://www.mastek. com/investor-information. These are also available on the websites of BSE Limited (www.bseindia.com) and the National Stock Exchange of India Limited (www.nseindia.com), where the shares of the Company are listed.

The mailing address of the Company is: Registered Office: 804 / 805, President House, Opposite C N Vidyalaya, Near Ambawadi Circle, Ambawadi, Ahmedabad-380006, Gujarat. Phone: +91-79-2656-4337; Fax: +91-22-6695-1331; E mail: [email protected]

Website: www.mastek.com

Corporate Office: Mastek Limited, 106/107, SDF IV, Seepz, Andheri (East), Mumbai – 400 096 Tel: +91-22-6722-4200; Fax: +91-22-6695-1331

E-mail: [email protected]

For the transfer of shares in physical form and noting your change of address, you need to write to Company’s RTA, (mailing address given in section 26 above). Transfer of shares in the electronic mode is effected through your Depository Participant only.

The Shareholding Pattern can be obtained from the website of the Company at https://www.mastek. com/investor-information. These are also available on the websites of BSE Limited (www.bseindia.com) and the National Stock Exchange of India Limited (www.nseindia.com), where the shares of the Company are listed.

Conference calls with the Investors/Analysts are held immediately after the announcement of quarterly results and the transcript of the said calls are displayed on the Company’s website at https://www. mastek.com/financial-information.

Apart from the quarterly meeting, Investors/Analysts meetings are also held with senior officials of the Company and the Intimation of the said meets are shared with the stock exchanges and also disclosed under Investor Information section on the website of the Company at https://www.mastek.com//investorinformation.

Name: KFIN Technologies Limited

Address: Selenium Building, Tower-B, Plot No 31 & 32,

Financial District, Nanakramguda, Serilingampally,

Hyderabad, Rangareddy, Telangana India – 500 032.

Email: [email protected]

Toll Free: 1800-309-4001

KPRISM: https://kprism.kfintech.com

KFIN Corporate: https://www.kfintech.com

Corporate Registry (RIS): https://ris.kfintech.com

Investor Support Centre: https://ris.kfintech.com/clientservices/isc

SEBI has mandated that, effective April 1, 2019, no share can be transferred in physical mode. Hence, the Company’s RTA has stopped accepting any fresh lodgement of transfer of shares in physical form.

For the transmission of shares in physical form and noting your change of address, you need to write to Company’s RTA.

Transfer of shares in the electronic mode is effected through your Depository Participant only.

Mastek’s shares are listed in India on National Stock Exchange of India Limited and BSE Limited.

You may contact Company’s RTA, who will advise you accordingly. You may also communicate with the Company in the event of any unresolved issues via Email at [email protected].

The Company extends ACH mode facility to all its members since longtime. The dividend amount of members availing ACH mode facility is directly credited to their Bank accounts. Members holding shares in physical form may submit a request letter with copy of cancelled cheque to RTA for availing ACH mode facility. Those holding shares in demat form are advised to please update their Demat Account details with proper and correct Bank account details with their Depository Participant.

The Company’s shares can be purchased in India either through a stockbroker or through any financial institution that provides brokerage services at the BSE or NSE. The Company does not offer a direct share purchase plan to outsiders.

Yes. The Company follows quiet periods i.e. Trading Window Closure, which is made every quarter prior to its release of quarterly results. During the quiet period, the Company or any of its designated officials will not discuss earnings expectations with any external parties. As per Company’s Code of Conduct for Prevention of Insider Trading, the Trading Window Closure of the Company for every quarter starts from last day of any fiscal quarter and will continue till 48 hours after the disclosure of such financial results / information to the concerned Stock Exchanges.

The Company’s shares are traded only in electronic form since June 2000. Shares can be dematerialised by opening the demat account with any of the Depository Participant (DP). DPs are some of the banks, brokers and institutions who have been registered with National Securities Depository Limited (NSDL) or Central Depository Services (India) Limited (CDSL). A comprehensive list of DPs is available at www.nsdl.com and www.cdslindia.com.

Pursuant to the provisions of Sections 124 and 125 of the Companies Act, 2013 and the Investor Education and Protection Fund Authority (Accounting, Audit, Transfer and Refund) Rules, 2016, and amendments made thereunder all the concerned shares in respect of which dividend had not been claimed or remained unencashed for 7 (seven) consecutive years or more is required to be transferred by the Company to IEPF Authority in specified Demat Account.

The web link to find out the Detailed list of Equity Shares / Dividends transferred to IEPF Authority is available on the website of the Company at https://www.mastek.com//investor-information as mandated by Ministry of Corporate Affairs (‘MCA’).

The Company had already transferred 48,285 shares in November, 2017 and 7,033 shares in January, 2018 (based on Un-Paid Interim and Final Dividend of year 2009-10 in November 2017 and January, 2018 respectively) to IEPF Authority Demat Account to comply with the said Rules.

In case the members have any queries on the subject matter and the Rules, they may contact the Company’s RTA. The Members / claimants whose shares, unclaimed dividend, etc. have been transferred to IEPF Authority can claim the concerned shares and unclaimed dividend by making an application to IEPF Authority in IEPF Form-5 (available on www.iepf.gov.in). The Member / claimant can file only one consolidated claim in a Financial Year as per the IEPF Rules. It is in the Members interest to claim any un-encashed dividends and for future, opt for Automated Clearing House (ACH) mode, so that dividends paid by the Company are

On account of the threat posed by COVID-19 and in compliance with the aforementioned MCA Circulars and SEBI Circular, the copies of the financial statements including Board’s Report, Auditor’s report or other documents required to be attached therewith (together referred to as Annual Report), Annual Report for Financial Year 2019-20 and Notice of Annual General Meeting is being sent only through electronic mode only.

Members are requested to follow the procedures as mentioned in the Notice of Annual General Meeting for registering themselves for receiving the further communications electronically.

Information about the Company is available on its website. Further, all information that is material in nature is notified to the stock exchanges and appropriate advertisements are also issued in the newspapers from time to time.

Members and Investors are also advised to go through the section on Management Discussion and Analysis and Investor information provided in the Report on Corporate Governance, as these and other parts of this Annual Report provide substantial information about the Company that you may find relevant and useful.

FAQ On de-merger

FAQ On de-merger

On June 12, 2015, the Mastek share price was adjusted for De-merger.

On April 30, 2015, the Hon. High Court of Gujarat and Hon. High Court of Bombay approved the Scheme of Arrangement, which was earlier approved by the Stock Exchanges on December 09, 2014. The Scheme envisaged creation of independent listed Insurance business company by demerger of Insurance business of Mastek to MCPL (renamed as Majesco Limited – “Majesco”). Post demerger Majesco achieved automatically listing with stock exchanges and all the shareholders of Mastek as on June 15, 2015 were allotted shares in Majesco in the same proportion (share entitlement being 1:1, pursuant to Part II of the Scheme of Arrangement in terms of clause 11.1.1)

Insurance Products & Services business is an IP driven business model and is largely US centric. This business needs investments to capitalize on the large opportunity in US market. At the same time, Vertical Solutions business which is focused in the UK market, needs to address newer opportunities and expand the client footprint. Restructuring will enable both the businesses to function independently and focus on their growth plans.

- Businesses are different in terms of business model, growth opportunities, investment required and staff profile.

While the Insurance Products & Services business offers us tremendous growth potential, it has high investment requirements in terms of R&D, Brand Building and sales.

The Vertical Solutions business offers steady growth which is more profitable with less investment. - Combining these businesses under one umbrella made it difficult for each of these businesses to perform to full potential.

- The differing risk-reward profiles of these two businesses led to sub-optimal overall performance of the company.

- In order to mitigate these challenges, management decided to restructure the business.

-

- Insurance Products & Services business with higher R&D investment and specialized skillsets will be able to gain market leadership. This will lead to higher license revenue and higher profitability.

- Solution enjoys good reputation for delivering complex, green-field programs within UK and Indian government. This restructuring presents an opportunity to focus on building new capabilities and addressing new markets within the vertical solutions business.

- Restructuring will provide an opportunity to the shareholders to participate in the business of their choice based on their risk reward profile.

- Demerger would facilitate independent value discovery of both the businesses leading to maximization of value for shareholders.

Every shareholder of Mastek will get 1 share in Majesco for every share held in Mastek and the shareholder will continue to hold the original Mastek share.

Post High Court approval, the scheme of arrangement was filed with the Registrar of Companies on June 01, 2015, which was the effective date of the transaction.

Appointed date for the demerger was kept as April 01, 2014 for convenience from an accounting perspective.

Majesco Limited got listed on August 19, 2015.

The share capital of Majesco Limited was the same as Mastek, on the date, the De-merger became effective.